The importance of Product Discovery in an era of hyper-choice

Hyper-choice is as likely to frustrate and annoy customers as it is to delight and satisfy them. At a time when retailers are struggling with falling customer spend, it’s essential their customers can find what they want, even when they don’t know they want it. A new report from London Research and Crownpeak looks at how retailers are turning to product discovery tools to improve the shopping experience.

We are living in an era of hyper-choice. Almost every shop we might want to visit has an online presence, and every store has almost infinite shelf space. But having everything we might want just a mouse-click away is as likely to cause frustration, FOMO and buyer’s remorse as it is to provoke delight and satisfaction.

Hyper-choice creates problems for retailers too. They don’t have the data and metadata they need to present the right products to the right customers. They have too many customer personas to match shoppers with products accurately. And their siloed processes and technologies mean they can’t create the ‘single customer view’ needed for true personalization of messaging.

These issues have only escalated as people continue to struggle with the rising cost of living. As a new report from London Research in partnership with Crownpeak shows, this crisis has seen over half (55%) of retailers hit by falling average order values, while over a third (37%) report a drop in site traffic, and 33% say their conversion rates have declined.

In this environment, ecommerce companies can’t risk losing customers to competitors because they can’t find what they want, or because they can’t decide between different options. Increasingly, retailers are turning to product discovery technologies to make shopping on their sites easier. The results are increased sales and revenues, improved customer loyalty and an enhanced customer experience.

Market leadership is strongly linked to a strategic approach to Product Discovery

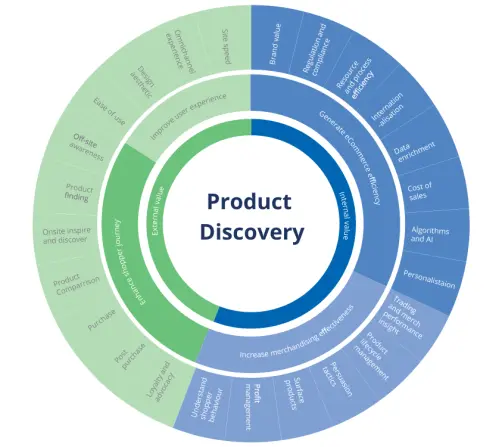

Gartner defines product discovery as a combination of “merchandising capabilities, category and landing pages for SEO and promotions, semantic search technologies and integrated personalization” which “can be adopted without needing to rebuild entire digital commerce platforms.”

A key finding of the London Research/Crownpeak report is that developing a strategic approach to product delivery is strongly linked to establishing a leading position in the market.

The report – The State of Product Discovery in Digital Commerce 2023 – shows that leaders in ecommerce are:

64% more likely to have an integrated approach to product discovery, including site search, merchandising and personalization, than mainstream retailers are;

51% more likely to be focusing on search relevance and optimisation;

63% more likely to be focusing on content-driven omnichannel commerce experiences;

62% more likely to see product discovery as a core strategy to improve conversion and AOV; and

59% more likely to look at AI to optimise their product discovery capability.

These results are underpinned by ecommerce leaders’ greater understanding of their customers’ journeys. They’re 78% more likely than their mainstream counterparts to recognise that shopper experiences are made up of ‘micro-moments’; small, intent-driven interactions that are critical to progress along the path to purchase.

Leaders are also 28% more likely to recognise that these micro-moments aren’t linked in a linear way. Customers no longer move smoothly from awareness to interest to consideration to action (if they ever did). Instead, leaders understand that their customers interact with the brand across multiple touchpoints according to their own information needs.

These leaders are more than twice as likely as the mainstream players to recognise the precise intent and specific goals of individual shoppers at the exact moment of engagement. So they can deliver the exact information each customer needs in order to progress to the next stage of their journey.

What’s changed?

The new report follows on from similar research carried out by London Research in 2021. Since then, retailers see this ability to deliver personalized content and product experiences as the single most important capability of a product discovery solution, ahead of others such as customisability and ease of use.

The report also finds that the implementation of the right product discovery solution can deliver impressive results. Retailers report the problems caused by the volume of products on offer are markedly less significant than they used to be.

The proportion who ‘strongly agree’ that shoppers on their site struggle to make a decision because there are too many products has fallen from just less than a third (31%) to under a quarter (22%). Similarly, the proportion who strongly agree that shoppers have difficulty finding products that genuinely interest them has fallen from 25% to 18%.

Looking forward, the danger for mainstream companies is that leaders are better equipped to deal with the next big technological leap. Eight out of ten retailers say they’re looking at AI as a way to improve their product discovery capability.

But while nearly three-quarters of leaders say AI capabilities are definitely a consideration in their product discovery technology investment decisions, only a third of mainstream companies say the same. The risk is that more enthusiastic adoption of AI by leaders widens the gap between them and their mainstream competitors.